A liquidity-driven investment strategy

Ultra MMM Fund is designed to transform liquidity from a passive reserve into an active financial infrastructure.

The fund operates through short-term liquidity deployment activities that generate returns without engaging in market speculation or the acquisition of traditional financial instruments.

A different approach to liquidity

Unlike money market or bond funds, Ultra MMM Fund does not rely on directional market exposure.

Liquidity is employed within regulated operational frameworks, allowing it to produce stable and consistent returns while maintaining a strong focus on capital efficiency and risk control.

Returns are generated through infrastructural and operational services, not through market bets.

Institutional structure, accessible vision

Ultra MMM Fund is structured to meet institutional standards while remaining accessible to sophisticated investors and high-liquidity corporate entities seeking a reliable and efficient liquidity management solution.

The fund is part of the Arxavia ecosystem, designed to ensure transparency, regulatory alignment, and operational continuity.

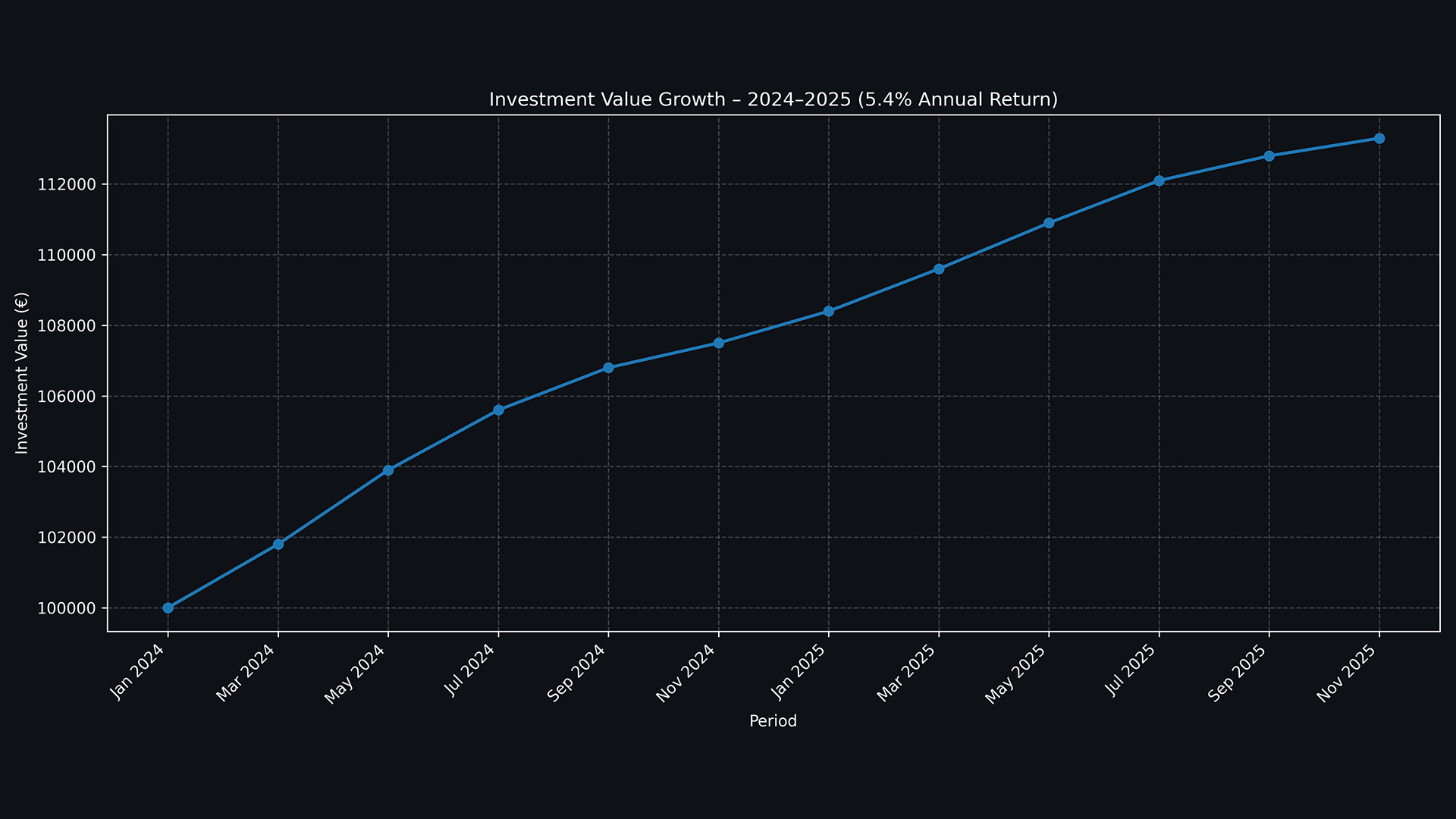

Performance snapshot

-

Year-to-Date (YTD): +5.4%

-

Focus on stability and consistency

-

Controlled optimization phases reflected through gradual adjustments in growth trajectory